flow through entity tax break

Unlike C corporations that subjected to double taxation flow-through entities are subjected to single taxation owners of entities are not taxed separately from the entities. The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee.

Pin On Exceptional Tax Services

Privately held business entities organized as flow-through entities face unique state tax issues under FASB Accounting Standards Codification ASC Topic 740 relating to the accounting for uncertainty in income taxes.

. Common Types of Pass-Through Entities. Flow-through Entities Tax Articles. When an investor is looking to purchase a flow-through entity they are doing so because they believe that they can receive.

As well as links to websites and other resources of interest to the flow-through entities tax community. Flow-through entities are used for several reasons including tax advantages. Strategic tax services for pass-through businesses and partnerships.

The law signed by Whitmer on Dec. Flow-through businesses include sole proprietorships partnerships and S. The Moment of Truth.

Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate. The majority of businesses are pass-through entities.

This is an interesting conundrum because you pay tax on profits whether or not you take any distributions. Is elected and levied on the Michigan portion of the positive business. Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005.

We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt. The tax break allows owners of pass-through businesses like sole proprietors partnerships and S corporations to deduct up to 20 of their business income from taxes. The benefits and tax obligations of operating flow-through entities and pass-through businesses are more complex than ever.

The decision may be tougher than first thought according to Jim Biehl a CPA and shareholder at Clayton. According to information released by the state the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of. Up to 25 cash back Under the Tax Cuts and Jobs Act pass-through business entity owners can potentially deduct 20 of their business income.

Company X is owned by two businessmen in Los Angeles. The basic financials of X are as follows. Simple Fair and Pro-Growth.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Tax Advantages Of Esops Employee Stock Ownership Plan How To Plan Capital Gain Pass Through Taxation What Small Business Owners Need To Know. The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations.

The Tax Cuts and Jobs Act TCJA the massive tax reform law that took effect in 2018 established a new tax deduction for owners of pass-through businesses. The main difference between the two entities is the tax advantages. The Michigan FTE tax.

To C or not to Cthat is the question for many business ownerswhether tis nobler to organize as a flow-through entity with future planning flexibility or convert to a C corporation with a better tax rate. Pass-through owners who qualify can. Report of the National Commission on Fiscal Responsibility and Reform December 2010.

20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan. In the end the purpose of flow-through entities is the same as that of the other business entities. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the.

Types of Flow-Through Entities. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. Pass Through Entity Tax Treatment Legislation Sweeping Across States Bkd.

Llcs are what is known as a flow through entity. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. 2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act.

Since it is a flow-through entity the owners must report their earnings as income when filing per. Follow the links below for more information on these topics. Flow through entity tax break Wednesday March 9 2022 Edit.

This requires many business owners and members of flow. Flow-through entities are however not exempted from filing the K-1 statement with the Internal Revenue Service in the United States. Individuals with taxable income in the 24 bracket may have their flow-through income taxed at 192 24 20 192 for a savings of only 48.

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Business entity which is transparent for tax purposes. Michigan Flow-Through Entity FTE Tax Overview.

Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. For federal purposes only a small percentage of flow-through entities pay income taxes and if the scope of ASC 740. By Stephen Fishman JD.

It also includes an llc taxed. This deduction began in 2018 and is scheduled to last through 2025that is it will end on january 1. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

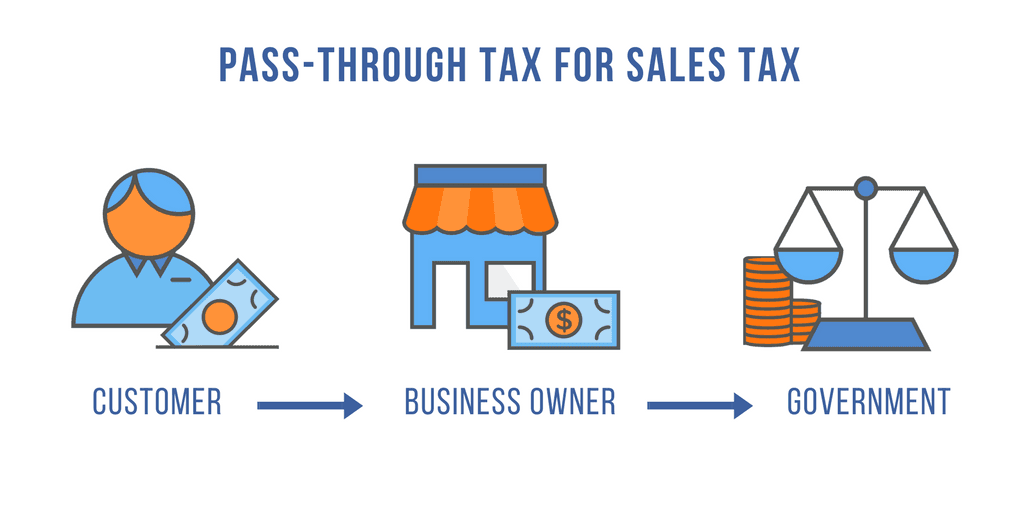

Regulations continue to change the thresholds and treatment of both revenue and expenses for many organizations. Recent Comprehensive Tax Reform Proposals. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Business Tax Deductions Business Tax

I Will Help You Form Your Llc In Any Of The 50 Us States Ad Affiliate Llc Form States Limited Liability Company Llc Business Llc

Pass Through Taxation What Small Business Owners Need To Know

1 Treds Platform Online Trading Technology Solutions Business Finance

Fifo Meaning Importance And Example Accounting Education Accounting And Finance Accounting Basics

How To Fearlessly Choose An Incorporation Type For Your Startup Business Checklist Start Up Start Up Business

A Complete Guide To The Singapore Corp Pass A New Digital Identity For Companies To Transact With The Gov Singapore Business Business Infographic Infographic

Benefits Of Incorporating Business Law Small Business Deductions Business

Qbi Information For Pass Through Businesses Business Sweepstakes Winner Writing

Tax Excellence Team Hot And Major Tax Issues Best Solutions Call Now For Enroll Today 02134329107 To 109 03343223163 Solutions Emphasis Commercial

What Is The Best Type Of Company Co Inc Llc Corp Ltd Etc And What Do They All Mean Business Tax Business Structure Law Firm Business

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Tax Business Tax Deductions Business Tax

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

Tax Advantages Of Esops Employee Stock Ownership Plan Business Leadership How To Plan

What Are The Benefits Advantages Of Cash Flow Statement Cash Flow Statement Cash Flow Cash Management

How To Read A Balance Sheet Balance Sheet Template Business Plan Template Online Business Plan Template